The aftermath of altseason brought Bitcoin price to a year-to-date (YTD) high. The bellwether of the cryptocurrency market recently recorded explosive upside price movements with altseason playing an indisputable role.

Bitcoin trading in June and the majority of July was devoid of volatility and volume. Monthly trading volume in June was the lowest since March 2019 and July volume was even lower!

But over these months, a hype originating in DeFi started spreading to the wider altcoin market and sparked the first altseason since early 2018. Risk appetite of crypto investors started shifting to the bullish side which eventually found its way to the Bitcoin market.

In the latest VYSYN Ventures analysis, we breakdown how altseason played a key role in pushing Bitcoin beyond a key market level. We also detail how this BTC price rise completely changed the dynamics of the Bitcoin market.

Altseason Sparking Bitcoin Price Rise

From June to early July, Bitcoin and altcoin price movements moved virtually in lockstep. But over this timeframe, a perfect storm was brewing for some crypto speculators.

DeFi investors had been experiencing extraordinary returns. Through “yield farming” and “liquidity mining” activities, some investors were securing annual percentage yield (APY) returns of over 100%.

Some DeFi speculators took extreme risk by leveraging up through providing liquidity with borrowed capital. In many cases, these high-risk activities have paid off for speculators as the native token of DeFi protocols recorded price increased along with the total value locked (TVL) in DeFi.

(Source: Defipulse.com)

After TVL in DeFi increased by roughly 79% in June, this acted as a key driver for the ensuing altseason. In early July, the altcoin market began to steer away from the Bitcoin market.

Bitcoin continued to trade in a range with low volatility and volume for most of July but altcoins began recording significant price increases. With DeFi playing a key role in sparking altseason, it is unsurprising that Ethereum outperformed the wider altcoin market. The vast majority of DeFi protocols and tokens have been built on the Ethereum blockchain.

(Source: Tradingview.com)

As the strong altcoin price performance persisted, sentiment data showed that crypto investors began to hold a more bullish outlook after the 22nd of July. This was followed by a paradigm shifting price rise in Bitcoin on the 27th of July.

How Surpassing a Key Level Has Shifted Bitcoin Dynamics

(Source: Tradingview.com)

Since Q4 2019, Bitcoin has repeatedly failed to sustain price values above $10,500. Strong seller liquidity has always been found near this level and each failure to surpass this level has been followed shortly by a drop below the important $10k level.

Furthermore, any bullish narratives which were surfacing quickly dissipated as the BTC market demonstrated that there was not sufficient demand-side pressure to maintain values above $10.5k. On July 27th, an 11% increase in Bitcoin brought price far above this pivotal level.

Dynamics quickly shifted after Bitcoin price surpassed this level. Sentiment data became markedly more bullish with the outlooks of crypto investors becoming the most optimistic since July 2019.

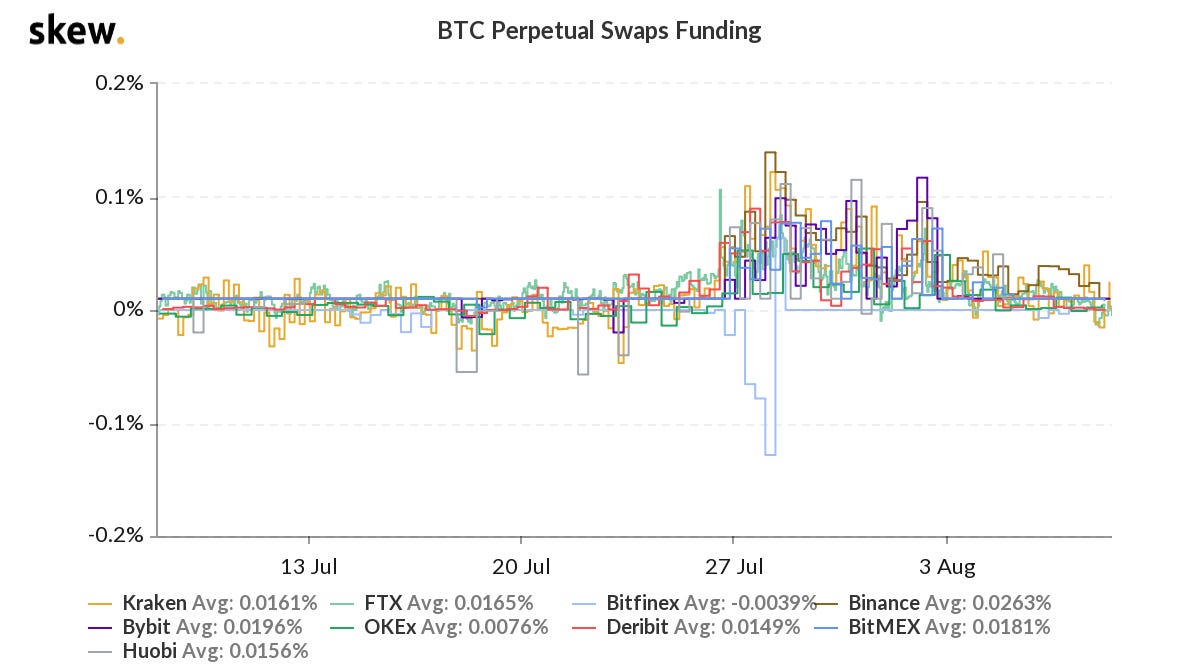

Those in the derivatives market took leveraged long positions in anticipation of further price rises. Perpetual futures interest rates – a metric to gauge whether derivatives speculators are long or short – increased significantly.

(Source: Skew.com)

The importance of $10.5k as a level was further highlighted when price retraced to test this level on July 28th and August 2nd. The drop to $10.5k on August 2nd came shortly after price rose above $12k and sparked roughly $147 million in liquidations on BitMEX. This highlights that the vast majority of speculators were highly leveraged and expected price to continue to rise.

Bitcoin has arguably been in a long-term downward trending market since June 2019 when a high of close to $14k was formed. The July 27th price jump brought Bitcoin above the 61.8% and 66% retracement levels from this downtrend. From a technical analysis standpoint, this increases the odds that price can return to the $14k highs and move higher.

(Source: Tradingview.com)

Dominant Bitcoin Narratives

With Bitcoin now trading above this key level, price action is much more susceptible to upside movements. Any bullish narratives which surface are far more likely to stick and build investor expectations.

There have been several bullish narratives that analysts have recently been noting which hold potential to manifest in explosive upside price movements. One interesting narrative which analysts have been monitoring is the correlation between Bitcoin and Gold.

(Source: Skew.com)

The 1-month correlation coefficient between gold and Bitcoin recently hit historic highs of 0.689. Gold is widely considered a risk-off asset by macro market participants and Bitcoin trading being closely tied to gold could strengthen its standing in the eyes of serious investors.

Strictly from a data analysis perspective, there is also a lot of reason to be bullish. Major Bitcoin purchasers such as Square Crypto and Grayscale have recently revealed that they have been ramping up buying activities.

Furthermore, the supply of Bitcoin has been more constricted. Since the May 2020 halving, the amount of new issuance arriving on the market has been cut. In addition to the supply cut, the number of BTC current holders have been willing to sell has been at all-time lows.

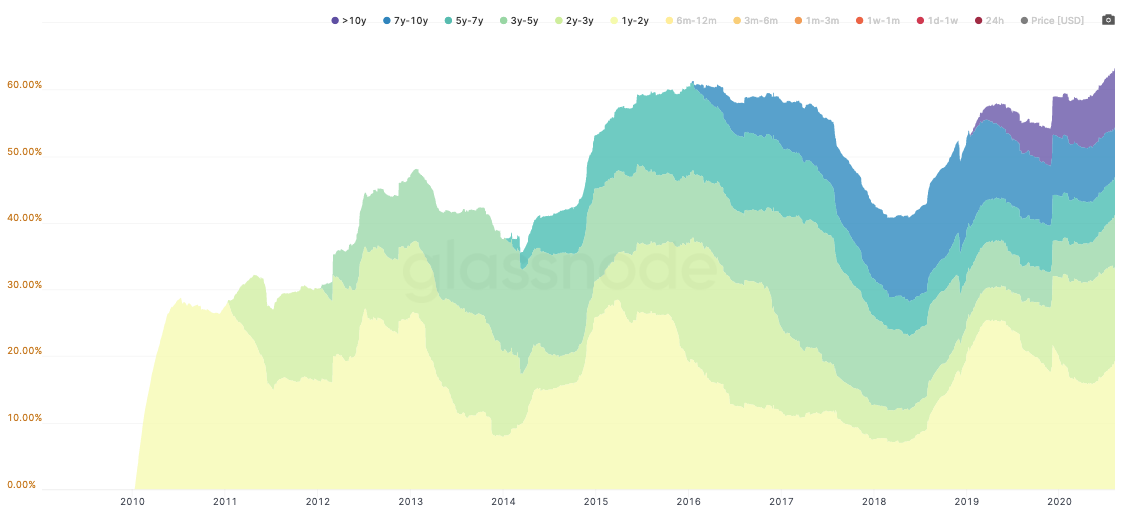

HODL waves can be used to assess how much Bitcoin has been changing hands among market participants. The 1-year HOLD wave – the amount of Bitcoin holders who have not moved their BTC for one year or longer – recently reached record highs of 63%. Assuming that demand remains constant, less holders willing to sell their holdings should push price up.

(Source: Glassnode Studio)

Will BTC Be the Asset of 2020?

After a shaky start to the year which resulted in a Q1 price low of ~$3,500, recent developments in Bitcoin make it far more likely to record significant upside price movements in the remainder of the year. An unexpected altseason increased the risk appetite of crypto investors and provided the necessary fuel for BTC to sustain values above $10.5k.

With Bitcoin trading far above $10.5k, bullish narratives are far more likely to translate to higher BTC prices and the odds are higher of price pushing past the $14k highs formed in June 2019. Furthermore, demand-supply dynamics have favourably adjusted with major purchasers ramping up buying activity and current holders keeping their supply for longer.

After the recent price developments, Bitcoin may be shaping up to be the asset of 2020. After surpassing $10.5k, Bitcoin is much more strongly positioned to record upside price movements shortterm.