Selling Pressure Intensifies As LFG Liquidates Its Bitcoin Position

VYSYN Weekly Release #97: Luna Foundation Guard moves to defend UST peg

Over the past week, the cryptocurrency market witnessed intense selling pressure amid unfavorable market conditions. The volatility was further exacerbated by wider macro issues including the Federal Reserve's latest interest rate hike. Bitcoin was hit with heightened selloffs as the Luna Foundation Guard (LFG) took a gamble with its Bitcoin reserve to defend UST's peg.

This week's edition of the VYSYN Release will give a comprehensive overview of the UST situation. We will also analyze how this and wider macro factors are affecting Bitcoin and the present outlook for the crypto market.

The rise of Terra's algorithmic stablecoin

In September 2020, Terraform Labs presented the cryptocurrency market with a unique product offering — TerraUSD (UST) — an algorithmic stablecoin. UST was designed to maintain a stable value as it is backed by a unique, decentralized mechanism, unlike other stablecoins backed by centralized assets.

UST maintains its peg to the US dollar via a mint and burn mechanism using Terra's native token, LUNA. Thus, whenever a new UST token is minted, $1 worth of LUNA will be burned. This contract makes it possible for investors to redeem LUNA for UST dollar-for-dollar and vice versa.

Terra intended for LUNA to be a stabilizing mechanism to help bring the price of UST back to $1 when it deviates. If UST falls below $1, investors get an arbitrage opportunity to buy a UST and then trade it for $1 worth of LUNA. An enormous proportion of UST's circulating supply is on the Terra-based money market Anchor Protocol, and it pays investors up to 20% annual percentage yield (APY) for staking UST.

With the crypto community voicing concerns about LUNA’s underlying value, the Luna Foundation Guard (LFG) decided to buy Bitcoin and AVAX as reserve assets to further stabilize the UST stablecoin earlier this year. It spent over $3 billion purchasing both cryptocurrencies. With severe market conditions surfacing, the LFG executed a multi-billion dollar gamble to save UST.

UST depegs amid severe unfavorable market conditions

Severe volatility is a disaster for stablecoins and UST faced no shortage of it in the past few weeks. Over the weekend, the algorithmic stablecoin started to deviate from its $1 peg in the light of macro uncertainties affecting the market.

Amid wider crypto market conditions, UST deposits into Anchor Protocol dropped substantially as over $5 billion worth of UST was drained out of the DeFi lending application. This figure represents a third of the entire market capitalization.

In what is now considered a "coordinated attack" to depeg UST, the stablecoin was hit with multi-million dollar selloffs as whales dumped their UST holdings. A single whale dumped $108 million worth of UST on Binance and another $85 million on Curve. UST lost its footing and plunged below $1 over the weekend. The collateral damage was extensive. LUNA's market cap dropped from over $30 billion to $10 billion and its price is down 64% over this time frame.

(Source: TradingView)

In an effort to defend UST's peg, the LFG announced a $1 billion loan in Bitcoin and UST from its reserve. The capital was lent to an unnamed "professional market maker" to conduct trades on both sides of the market. Half of the lent capital, $750 million worth of Bitcoin, would be used to make UST purchases if its peg continued to slip below $1. The other $750 million UST would add Bitcoin to the LFG's reserve if UST's peg was equal to or greater than $1.

This move did little to help as further selloffs drove UST price below $0.65. This prompted several longtime UST critics to draw parallels between UST and other failed stablecoin projects. One Twitter user referenced Iron Finance. Iron Finance was the first large-scale bank run within the crypto industry.

In a desperate attempt to save UST, the LFG emptied its $2.2 billion Bitcoin reserve. Despite deploying all of the Bitcoin in its portfolio, as well as hundreds of millions of dollars in UST to market makers to bootstrap liquidity and stabilize prices, UST has still not fully recovered.

(Source: BitInfoCharts)

Terraform Labs CEO, Do Kwon quickly sought to clarify speculations that Terra has sold its Bitcoin holdings. Kwon noted that the Bitcoins have not been sold but are used to try to steady UST's price. He said, "To clarify, the bitcoin will be used to trade, but the stronger intent is to signal peg strength to the market as capitulation sentiment has set in… LFG is long bitcoin."

Is Bitcoin optimism failing?

Amid the latest market turbulence, Bitcoin's price has plummeted to its lowest levels since July 2021, as the digital asset briefly slipped below $30,000 on Tuesday. The cryptocurrency market tumbled in response to the latest monetary policy imposed by the Federal Reserve, losing over $300 million in the past few days.

The Fed raised its benchmark interest rate by 50 basis points (0.5 percentage points) and is also planning to introduce Quantitative Tightening (the removal of liquidity from the market) in June.

Additionally, because the Terra team flooded the market with Bitcoin in an effort to protect UST's peg to the dollar, it added further selling pressure to the digital asset. Bitcoin lost 10% of its value on Monday, dropping below $30,000 for the first time since July 2021.

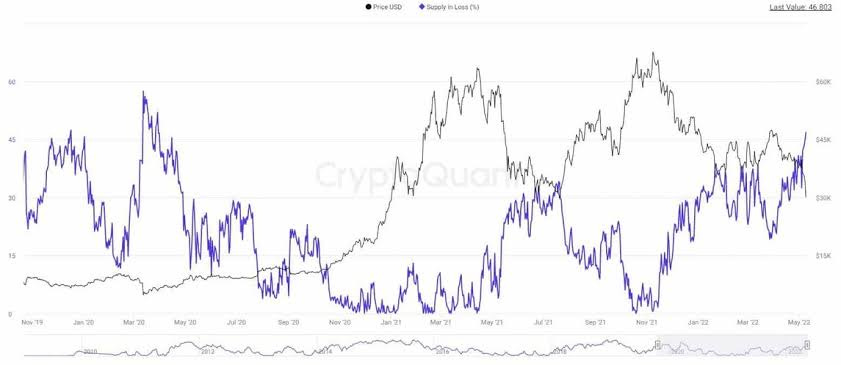

(Source: CryptoQuant)

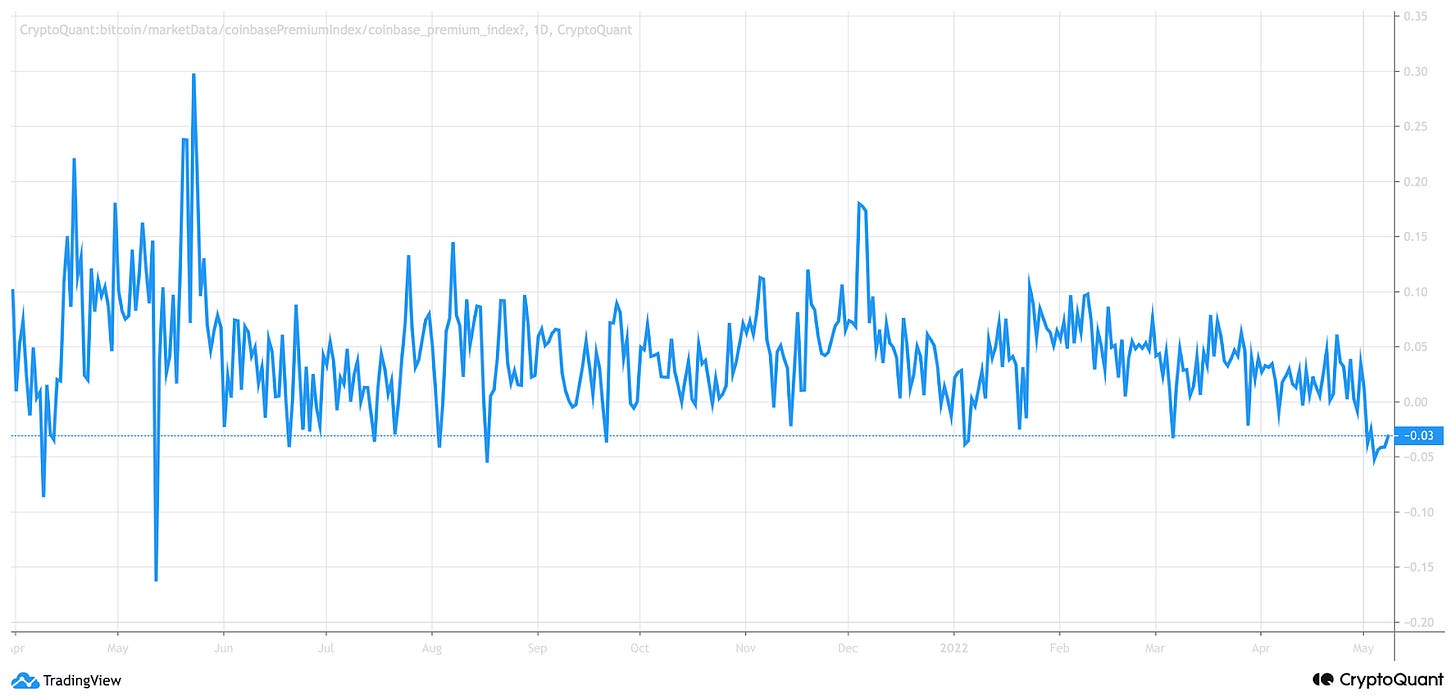

Amid the present market crisis, the Coinbase Premium Index, a popular indicator that shows a sign of whale accumulation, recently turned negative. According to CryptoQuant, the recent negative premium is an indication of heavy selling by institutional investors on Coinbase Pro.

(Source: CryptoQuant)

Interestingly, CryptoQuant's Binary CDD data reveals that long-term institutional investors are still holding their digital assets, with no intention to sell them anytime soon. It is crucial to understand that not all institutional investors are long-term buyers. Some are speculators and can sell off their Bitcoin holdings when market sentiments change.

In fact, MicroStrategy, the largest corporate holder of Bitcoin, stated that it is under no immediate pressure to liquidate its Bitcoin position under prevailing market conditions. The company's CEO, Michael Saylor pointed out that Bitcoin would have to drop to $3,562 for MicroStrategy to experience a margin call.

Crypto market analysts suggest that the latest price drop is an opportunity to buy Bitcoin at a discount. Tyrone Ross, CEO of Onramp Invest said, "When something goes on sale and you like it, you should buy it… I think we're not at mass adoption yet, but we are at mass acceptance." The Central American nation of El Salvador took advantage of this opportunity and added 500 BTC to its Bitcoin stash amid falling markets. Moved by El Salvador's commitment to its Bitcoin adoption decision, the Tron Foundation also purchased 500 BTC.

While the bearish trends appear to have persisted over the past few weeks, it is quite relieving for investors to know that long-term institutional investors are still not yielding to the selling pressure. There is yet another "hopium", a term used by crypto traders and investors for hopes of a quick market recovery and continued bull run. The dollar index's (DXY) chart suggests that DXY could be closing on an interim top. The dollar's weakness is usually considered to favour risk-on assets, including Bitcoin.

About VYSYN Ventures

VYSYN Ventures is a longstanding venture capital company that specializes in funding and supporting disruptive startups in the blockchain and cryptocurrency industry. We have provided early-stage support to several projects that have grown USD market capitalizations of hundreds of millions and even billions. Our incubation program focuses on providing capital allocation, versatile marketing support, and tech assistance.